-

Muoro

Django/Flask

Gurugram

Python . Django . API .25 May 2025 -

KnowDis AI

Data Scientist

Delhi

Python . AI . ML .10 May 2025 -

Deloitte

Generative AI

Bengaluru

Python . Django . AWS .10 May 2025 -

Vetic

Software Development II

Gurugram

Python . SQL . API .09 May 2025 -

E Com Street

Python Developer

Noida, Greater Noida

Python . ORM . Django .09 May 2025 -

Dataquad

Python Developer

Delhi/NCR

Kafka . Python . Flask Multithreading .07 May 2025 -

Futuresoft India

AI/ML Engineer

India

AI . ML . Python .06 May 2025 -

G4S

Data Analyst

Gurugram

Python . SQL . DS .06 May 2025 -

TIE-UPS

Business Analyst

Delhi/NCR

excel . python . PowerBi .06 May 2025 -

Xoriant

Python Developer

Pune

Python . OS . Splunk .05 May 2025

Nomura

Apply Here

Quants Analyst

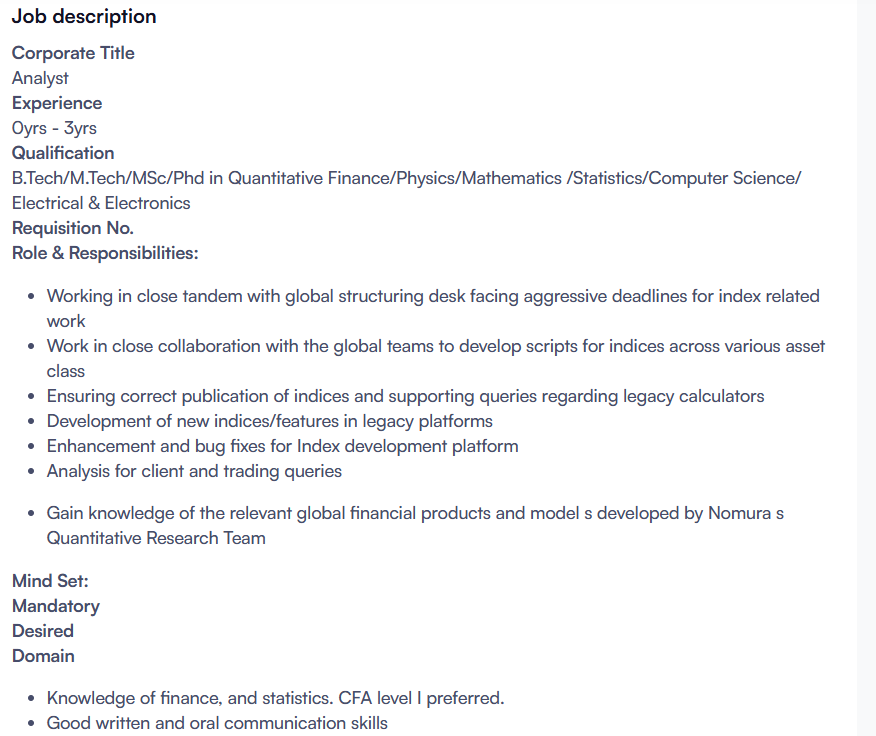

Job Description

Job Title: Analyst

Experience: 0 to 3 Years

Qualifications:

B.Tech, M.Tech, MSc, or PhD in Quantitative Finance, Physics, Mathematics, Statistics, Computer Science, Electrical & Electronics.

Role & Responsibilities:

- Collaborate closely with the global structuring desk to meet tight deadlines related to index work.

- Develop and maintain scripts for indices across various asset classes in coordination with global teams.

- Ensure accurate publication of indices and provide support for legacy calculator queries.

- Develop new indices and features on legacy platforms, and perform enhancements and bug fixes.

- Analyze client and trading queries effectively.

- Gain deep knowledge of global financial products and models developed by Nomura’s Quantitative Research Team.

Desired Mindset and Skills:

- Strong understanding of finance and statistics; CFA Level I is preferred.

- Excellent written and verbal communication skills.

- Good organizational and analytical abilities.

- Enthusiasm for using technology to solve complex problems.

- Comfortable working with large databases and datasets.

- Ability to work collaboratively within a team and strong work ethics.

Technical Skills:

- Proficiency in Python, C, C++, Java, and VBA.

- Familiarity with Bloomberg is an advantage.

- Good knowledge of Excel.

Industry: Financial Services

Department: Data Science & Analytics

Employment Type: Full Time, Permanent

Key Skills

Computer science

global operations

C++

Bloomberg

Quantitative research

Investment banking

Asset management

Information technology

Financial services

Python